Are you wondering if you could use a letter of character for credit? In this article, we will explore the potential benefits of using a letter of character to support your credit application. You will also find examples of letters of character that you can use as a template and modify as needed.

Exploring the Benefits of Using a Letter of Character for Credit

When applying for credit, lenders often look at your credit history and score to determine your creditworthiness. However, if you have a limited credit history or a low credit score, you may face challenges in getting approved for credit. In such cases, a letter of character can help strengthen your credit application by providing additional information about your character, integrity, and reliability.

Here are some key benefits of using a letter of character for credit:

- It can help demonstrate your trustworthiness to lenders.

- It can provide additional context about your financial situation.

- It can highlight your positive attributes and values.

- It can help compensate for a lack of credit history or a low credit score.

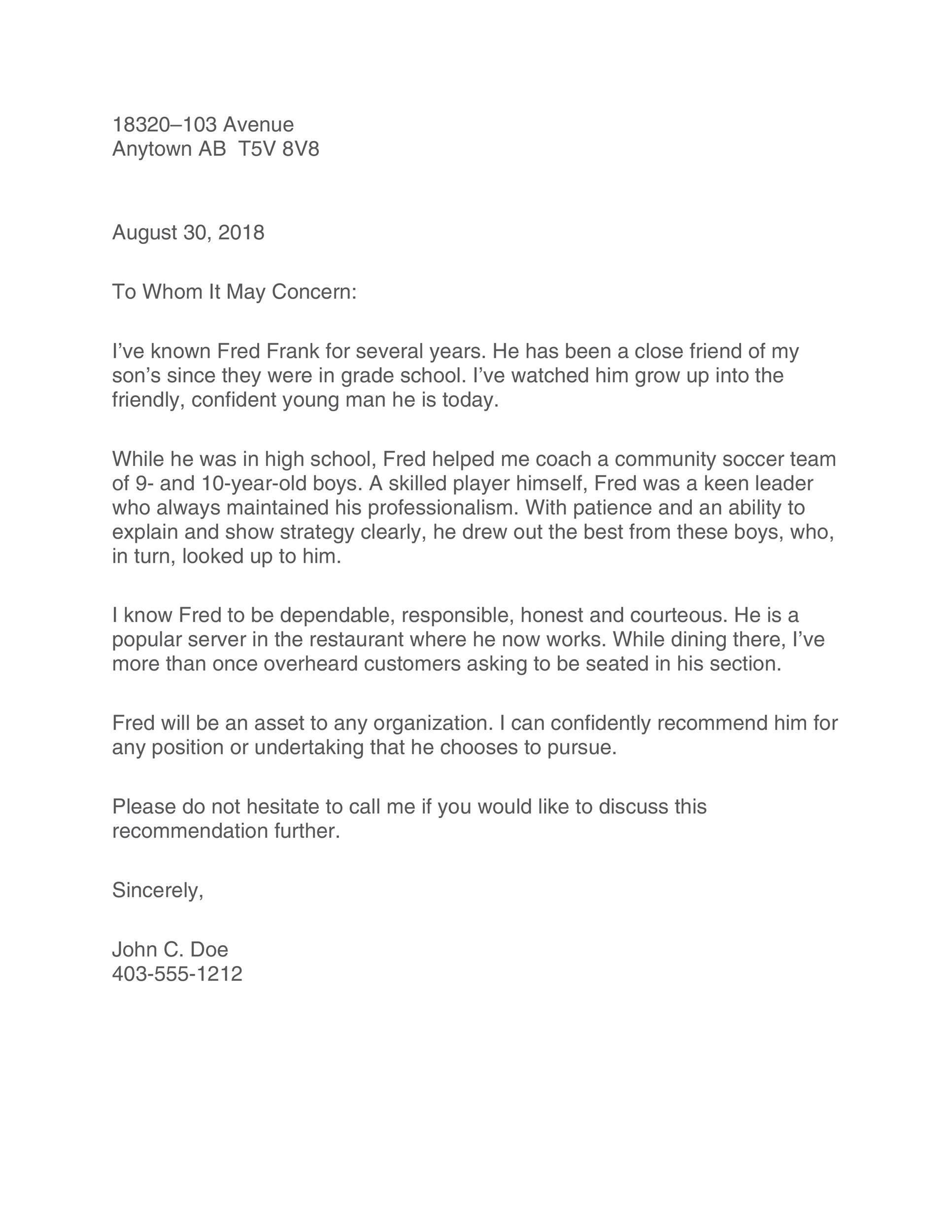

Example of a Letter of Character for Credit

Dear [Recipient’s Name],

I am writing this letter to attest to the character of [Your Name]. I have known [Your Name] for [Number of Years] years and can confidently say that [he/she] is a person of integrity, honesty, and reliability.

Throughout our friendship, [Your Name] has always been responsible with [his/her] financial obligations and has demonstrated a strong work ethic. [He/She] is a trustworthy individual who values honesty and transparency in all [his/her] dealings.

I believe that [Your Name] would be a reliable borrower and would honor [his/her] financial commitments. I am confident that [he/she] would manage any credit responsibly and make timely repayments.

Sincerely,

[Your Name]

Could You Use Letter Of Character For Credit

Letter Of Credit Meaning

38 Free Character Witness Letters (Examples + Tips) ᐅ TemplateLab

Character Letter for Court Form – Fill Out and Sign Printable PDF

6+ Credit Reference Letter Templates – Free Sample, Example, Format

Character Witness Letter Example For Court Database – Letter Template

Dui Character Letter Sample – Free Character Reference Letter (for